Determining child support payments can be complex, especially when considering variations in income and state laws. For parents earning $1,000 a week, understanding the calculation process helps ensure fair and adequate support for children. This article examines how child support amounts are typically calculated, key factors influencing these calculations, and current data to help you navigate this essential financial commitment.

If I make $1,000 a week, how much child support do I pay?

The amount of child support you may owe varies by state, but typically ranges from 10% to 20% of your gross income. Therefore, if you make $1,000 a week, you could pay between $100 and $200 per week in child support.

Understanding Child Support Calculations

Child support is a legal obligation intended to provide for a child’s basic needs, including food, shelter, education, and healthcare. Each state has its own guidelines for calculating child support payments, which often consider both parents’ incomes and the child’s needs.

Many jurisdictions utilize income shares models or percentage of income guidelines to arrive at a fair amount. Understanding these models can clarify how much you are responsible for paying.

Income Shares Model vs. Percentage of Income Model

| Model | Description |

|---|---|

| Income Shares Model | This model considers the combined income of both parents to determine child support obligations. The payments are intended to maintain the same standard of living for the child as if the parents lived together. |

| Percentage of Income Model | This approach sets a fixed percentage of the non-custodial parent’s income to be paid as child support. This percentage typically ranges from 10% to 20%, depending on the number of children. |

Most states fall under either of these categories. For example, if your state uses a percentage of income model and you earn $1,000 a week, you might pay between $100 to $200 weekly, depending on the number of children.

Factors Influencing Child Support Payments

Several criteria affect child support calculations beyond just income. Here are some critical factors to consider:

- Number of Children: More children typically increase the percentage of income designated for support.

- Custodial Parent’s Income: If the custodial parent has a significant income, the amount owed may be adjusted.

- Healthcare Costs: If either parent provides health insurance for the children, this expense can influence payments.

- Childcare Costs: Any necessary daycare or childcare expenses will be factored into the final child support amount.

- Special Needs of the Child: If a child has special needs, additional support may be required.

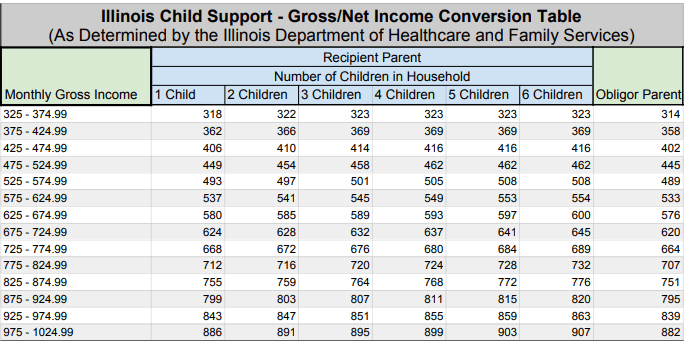

State Guidelines for Child Support Payments

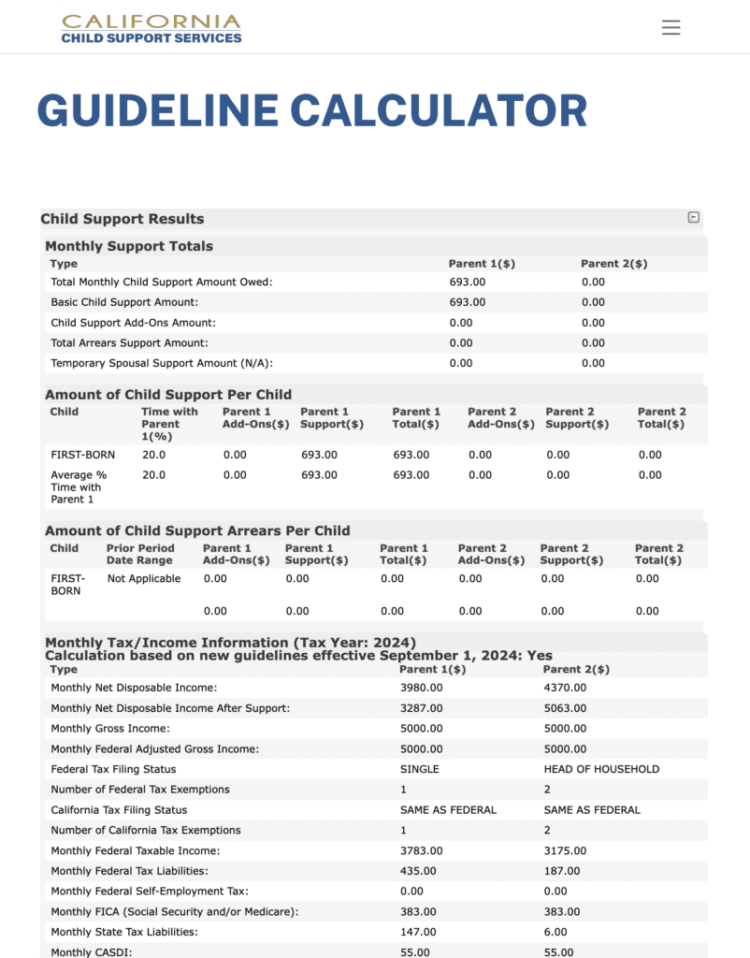

Child support guidelines differ significantly across states. The table below outlines average child support percentages by state for parents earning $1,000 a week with varying numbers of children.

| State | 1 Child | 2 Children | 3 Children |

|---|---|---|---|

| California | 20% | 25% | 30% |

| Texas | 20% | 25% | 30% |

| New York | 17% | 25% | 29% |

| Florida | 18% | 24% | 27% |

| Illinois | 20% | 28% | 32% |

Based on the above table, if you earn $1,000 weekly and live in California, your weekly child support payment for one child would be approximately $200. However, in Illinois, it could reach $200 for one child as well but may increase to $280 if you have two children.

Calculating Your Payments

To calculate your potential child support payments, consider using a simple calculator or consult with a lawyer familiar with family law in your state. Here’s a general formula to get started:

- Determine your gross weekly income: $1,000.

- Identify the appropriate percentage based on your state and number of children.

- Multiply your gross income by the percentage to find your weekly support amount.

For example:

- If you have one child in a state that mandates 20% of your gross income:

- $1,000 x 0.20 = $200 weekly.

Importance of Accurate Reporting

When determining child support, accurate reporting of income is crucial. If your income fluctuates, it’s advisable to provide documentation that reflects your average earnings. Failing to report accurately can result in penalties or increased payments down the line.

Modifications and Adjustments

Circumstances can change, leading to the need for modifying child support payments. Changes in income, employment status, or the financial needs of the child can all prompt a review of current support arrangements. To adjust support payments, a motion must typically be filed with the court, and both parties may need to provide updated financial information.

Seeking Legal Assistance

Navigating child support can be challenging, particularly when discrepancies arise between parents regarding amounts owed or changes in financial situations. Consulting with a family law attorney can offer clarity and ensure compliance with state regulations. An attorney can help interpret local laws and provide insight into potential modifications based on changing circumstances.

Conclusion

Understanding how child support is calculated if you earn $1,000 a week is crucial for fulfilling your obligations to your children. By familiarizing yourself with state guidelines, assessing your financial responsibilities accurately, and seeking legal advice when needed, you can navigate this essential aspect of parenting with confidence. Ultimately, the goal is to ensure that children receive the support they require, fostering their well-being and security for the future.